Using a trading plan is essential for any trader. It sets clear rules for when to enter and exit trades, how much to invest, and how to manage risks. This structure helps remove guesswork and emotions from trading. Here’s a trading plan pretty close to mine, but feel free to add your own details.

DT & DB Trading Plan

I read my trading plan regularly because it helps cement my trading rules and protects me from making emotional trades. It’s a roadmap that keeps me focused and disciplined. By following my plan, I avoid impulsive decisions that can lead to losses. I know that sticking to my plan increases my chances of success because it’s based on thorough research and a proven strategy.

When I follow my plan, I can stay consistent and objective, making decisions based on logic rather than fear or greed. Over time, this approach helps me achieve the positive results that my research has shown are the most likely outcome.

Goals

- Follow a Trading Routine: Establish a daily routine that includes checking news, checking for potential trade setups, and executing trades.

- Achieve Consistent Monthly Profits: Aim to make a consistent profit each month over the next six months.

- Increase Trading Account: I will increase my trading account over the 12 months by reinvesting all my trading income.

- Achieve Financial Independence: Work towards a level of profitability that allows me to rely on trading as my primary source of income within the next 3-5 years.

Important Rules

- Trust the plan

- Be patient

- Be disciplined

- Check for pending economic news every day.

- Do not trade news days.

- Do not trade public holidays.

- Day trade the London and New York sessions.

- Exit all trades before the close of the New York session.

- Trade the major and minor currencies.

- Do not trade exotic currencies.

- Do not exceed 1% account risk per trade.

- Automate trades by setting pending orders with stop-loss and take-profit in place.

- Do not exit trade early; adjust stop-loss or take-profit levels after setting.

- Do not attempt to trade economic news.

- Review performance weekly, monthly, and quarterly.

- More than four consecutive losses, take a break and review strategy.

- Update trading journal at day’s end.

The Strategy

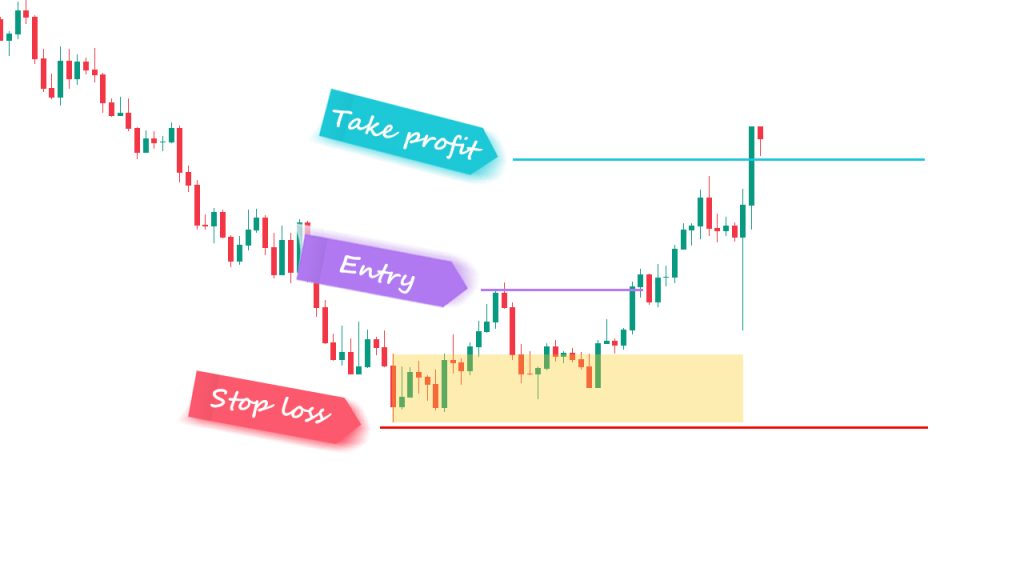

The DT and DB charts below represent grade-A-type setups I want to take. I aim to execute these types of setups without second-guessing their outcome. My goal is to execute without fear or favor.

Grade A DT Setup.

Grade A DB Setup.

Mind Game

Trading is a mental game, and it’s crucial to keep my psychological discipline strong. Success in trading isn’t just about analyzing charts it’s about managing my emotions and maintaining a long-term perspective. I must remind myself not to get hung up on the outcome of a single trade. Instead of focusing on the last trade, which can lead to emotional reactions like fear or overconfidence, I need to think about the next 100 trades. This long-term approach will help me develop consistency and resilience.

Thinking about the next 100 trades means recognizing that losses are a natural part of trading. Each trade is just one in a series, and what matters is my overall performance, not individual wins or losses. By sticking to my well-defined plan and focusing on my long-term goals, I can avoid the pitfalls of emotional trading and achieve steady progress. I must remember, trading is a marathon, not a sprint.

Now get after it!